How just 2 phone calls saved us $50 a month!

There are some bills you have no control over, like your electric bill. Yes, you can turn the air conditioner off and not use as many lights, but you are still at the mercy of what the power company charges per KWH.

However, there are some bills you can negotiate down with your service provider.

This is an excerpt from a guest post that originally appeared on MoneySavingMom.com in April 2014.

There are some bills you have no control over, like your electric bill. Yes, you can turn the air conditioner off and not use as many lights, but you are still at the mercy of what the power company charges per KWH.

However, there are some bills you can negotiate down with your service provider.

Last week, my husband called our internet service provider and cell phone carrier to see if we could lower our rates. We have been long-term customers of both and thought it wouldn’t hurt to see what they could do. Two phone calls later and we were saving a little more than $50 a month… and we could all use an extra $600 a year, right?

If you’d like to lower a few of your monthly bills, here are some of our tips:

Maximizing your Amazon Prime Membership

It's no secret that I LOVE Amazon. Let's face it, I love any opportunity to shop and not have to put on real pants.

Three years ago my husband and I decided to dish the dish and opt to use Netflix and Amazon Prime. I wasn't convinced Amazon Prime was worth the money, that was because I didn't understand ALL the benefits.

It's no secret that I LOVE Amazon. Let's face it, I love any opportunity to shop and not have to put on real pants.

Three years ago my husband and I decided to dish the dish and opt to use Netflix and Amazon Prime. I wasn't convinced Amazon Prime was worth the money, that was because I didn't understand ALL the benefits.

How we lowered our bills and you can too!

Bills are a part of life. You know they are coming. You know you have to pay them, but it doesn't make it any less pleasant.

Bills are a huge chunk of your monthly budget, but you have more control over them than you might think.

Today I wanted to share with you how our family has been able to lower some of our bills and add more margin to our budget and decrease our spending by $1,500 a year.

Bills are a part of life. You know they are coming. You know you have to pay them, but it doesn't make it any less pleasant.

Bills are a huge chunk of your monthly budget, but you have more control over them than you might think.

Today I wanted to share with you how our family has been able to lower some of our bills and add more margin to our budget and decrease our spending by $1,500 a year.

Fast meal planing to save BIG on groceries without coupons

Oh look! Another blogger writing about meal planning. Zzzzzzz....

No. Today I am going to talk about combatting the sky rocketing price of groceries by following a few simple meal planning strategies.

Oh look! Another blogger writing about meal planning. Zzzzzzz....

No. Today I am going to talk about combatting the sky rocketing price of groceries by following a few simple meal planning strategies.

8 tips to save on produce

Is it expensive to eat healthy? I would argue no. In fact the weeks I run to the grocery store to pick up produce and milk are the weeks I spend less even though I buy the same in volume.

Today I am going to share some tips on saving cash on produce.

(Side note: I am not claiming to be the healthiest of healthy eaters here. Don't get me wrong. But I am learning and I have made major life style changes. Baby steps, y'all!)

Is it expensive to eat healthy? I would argue no. In fact the weeks I run to the grocery store to pick up produce and milk are the weeks I spend less even though I buy the same in volume.

Today I am going to share some tips on saving cash on produce.

(Side note: I am not claiming to be the healthiest of healthy eaters here. Don't get me wrong. But I am learning and I have made major life style changes. Baby steps, y'all!)

8 tips to save money on major appliances

Let's face it, major appliances can be a major expense. Our family has purchased three large appliances in the past 12 months and without a preparation, planning and thought there is no way we could have pulled off those purchases.

Because we are a cash only family we paid for each of these appliances using our own savings. Today I will share some tips on how we save the MOST money.

Let's face it, major appliances can be a major expense. Our family has purchased three large appliances in the past 12 months and without a preparation, planning and thought there is no way we could have pulled off those purchases.

Because we are a cash only family we paid for each of these appliances using our own savings. Today I will share some tips on how we save the MOST money.

Preparing for Christmas when there is no money for gifts

I got a pretty heartbreaking note from a reader. I am not going to go into the details because it was so deeply personal, but she was scared, tired and overwhelmed. There is simply no money for gifts this year.

And in her message it was clear that this woman was trying to create a special Christmas for her family and friends in spite of her situation.

I got a pretty heartbreaking note from a reader. I am not going to go into the details because it was so deeply personal, but she was scared, tired and overwhelmed. There is simply no money for gifts this year.

And in her message it was clear that this woman was trying to create a special Christmas for her family and friends in spite of her situation.

I went to my YouTube community and asked what advice they could give her. The ideas were brilliant, but that doesn't surprise me. The women who watch my videos are just a great group of people.

You can watch the video here:

But here are some tips I hope will help.

Use what you have.

If you're like me you have a TON of free samples and empty baskets lying around. Put together a little gift basket. Or fill a mason jar with beauty products from your stash and make little gifts for your mom, your kid's teachers, or friends.

Give the gift of reading.

If you have a novel you love give it to a friend and include a nice note telling the person why you wanted them to have your copy.

Make a photo album.

If you have photos of the two of you together, or you have photos of their family make them a nice photo album. You probably already have an album in your home.

Upcycle a picture frame.

I did this last year and they turned out so cute. I just glued some buttons to a frame and that was it. And this 5 minute upcycled frame is great too.

Give things new life.

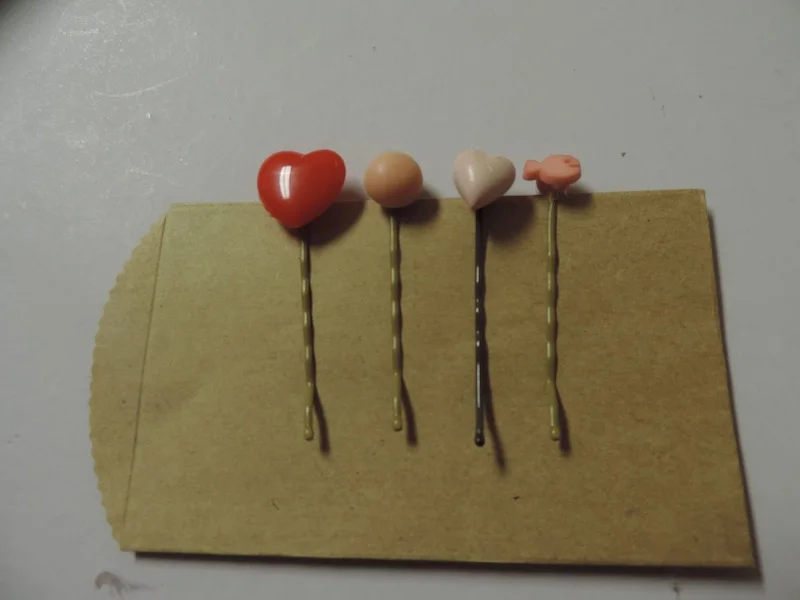

Last year I made these button bobby pins. They turned out so cute and would make a sweet gift for a daughter, niece or friend.

Bake something.

If you already have cake mix, bread mix or flour and basic baking supplies make some muffins, breads for cookies. I love baked goods and they don't clutter up my house!

Be honest with people.

I know it's hard. But be honest with people about your situation. You could say something like "our family isn't doing gifts this year. How about instead we all get together, bake cookies and watch "White Christmas."

Bottom line: Christmas is a celebration of the birth of Jesus Christ. It is the celebration of grace and mercy and the purest love imaginable. It is not a time to stress out.

Do you want the people you love to stress out because of your birthday? No.

So. What do you think? What are your suggestions for $0 Christmas gifts?

Don't Make Christmas a Season of Financial Stress

Christmas is a wonderful season of hope and the reminder of the true meaning of Christmas. But Christmas can easily become a season of stress.

My new favorite couponing app!

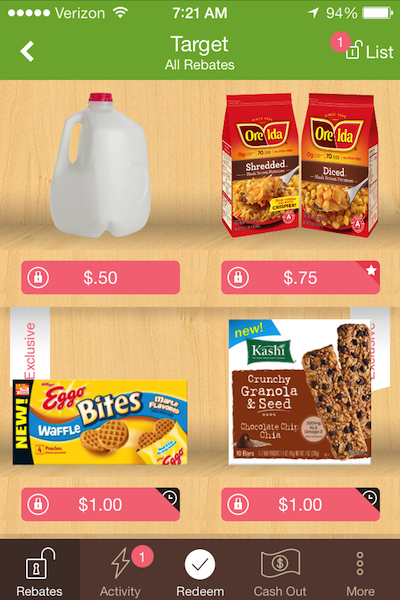

Okay, so you have probably figured it out by now but... I LOVE SAVING MONEY!!! And as I have mentioned before, we live on a budget. And one of the few places where you have the most control over your budget is in the grocery department.

The problem I have is that we buy a lot of fresh produce, milk and eggs. And there aren't many coupons for that. But then I learned about Checkout 51! It was so exciting. One of the girls on my YouTube asked if I had heard of Checkout 51 and I hadn't. So I looked it up and I was instantly hooked.

Okay, so you have probably figured it out by now but... I LOVE SAVING MONEY!!! And as I have mentioned before, we live on a budget. And one of the few places where you have the most control over your budget is in the grocery department.

The problem I have is that we buy a lot of fresh produce, milk and eggs. And there aren't many coupons for that. But then I learned about Checkout 51! It was so exciting. One of the girls on my YouTube asked if I had heard of Checkout 51 and I hadn't. So I looked it up and I was instantly hooked.

All I did was download the app and I was able to peruse lots of deals that would allow me to get cash back for my grocery purchases. I simply use the app to snap a photo of my receipt when I am done shopping and bam! The next thing I know Checkout 51 has added money to my account. Once my account balance reaches $20 they mail you a check.

My favorite thing is the deals are not usually limited to a particular store. I was able to use it at the farmer's market. THE FARMER'S MARKET!!! So I was able to by locally grown produce from a locally owned store and save money! That's a win in my book.

Also there are a ton items to choose from including fresh produce and eggs!

I highly recommend heading over to their website to look at the Checkout 51 offers.

What is your favorite couponing app?

NOTE: This post contains affiliate links. Please read my disclosure policy here.

No Spend August- Our Second Month-Long No Spending Challenge

A brand new month starts on the end of the week. I don't know why, but I love it when a new month starts on the weekend. It's like you don't have to process as much mental paperwork because it's the weekend. Maybe that's just sign 8,324 that I am strange.

Starting Friday we are beggining another No Spend Month. For the month of August the Senn Family has committed to not spending money outside of our basic obligations.

A brand new month starts on the end of the week. I don't know why, but I love it when a new month starts on the weekend. It's like you don't have to process as much mental paperwork because it's the weekend. Maybe that's just sign 8,324 that I am strange.

Starting Friday we are beggining another No Spend Month. For the month of August the Senn Family has committed to not spending money outside of our basic obligations.

You may remember that we did this back in February with great success.

No, our children didn't go hungry, or sitn dirty diapers. And all of our bills got paid. In fact it was so succesful that in the middle of it we paid our final debt!

We've decided to do it again.

All month long we won't:

- be buying cups of coffee from Starbucks

- hitting up the drive through for breakfast (ahem Jason)

- buying books for our Kindle (ahem Lydia)

- stopping by Zaxby's for lunch after church

- buying things simply because they are a good deal

Our spending in this house is not exorbitant, but like many people we can still reel it in. And then we can get a good idea of where our money is actually going.

Will you join us in No August? Maybe you can make your commitments small. Decide to cut out a soda from the vending machine everyday, commit to brown bagging your lunch or say no to an app purchase or movie rental.

What are some things you could give up for the month?

Frugal, Debt Free Wedding Gift

My college roommate is getting married! I am so excited. The last time I was this excited about a wedding, it was my own.

And Karen, the upcoming bride, was one of my bridesmaids. I really love her and I am just thrilled for her.

This past weekend I attended a bridal brunch and being committed to a frugal debt free life, I wanted to give her something nice, but also inexpensive.

My college roommate is getting married! I am so excited. The last time I was this excited about a wedding, it was my own.

And Karen, the upcoming bride, was one of my bridesmaids. I really love her and I am just thrilled for her.

This past weekend I attended a bridal brunch and being committed to a frugal debt free life, I wanted to give her something nice, but also inexpensive.

A little background on our current "financial situation." We recently paid off all our debts. That means, we don't owe anyone anything. And we are currently saving for a house. And since it is our desire to either pay cash for a house (don't laugh.) Or buy a house and pay it off in just a couple years, we are living on a slim portion of our budget.

This is self-imposed, but we are doing this so that I can stay home with our kids longer, we can give to those in need as we feel called without constraints, and so we can fund retirement and our kid's college educations. (No, I don't like student loans.)

So that means that our "gift" budget is slim. So I found a creative way to stretch that budget and still give my friend something nice.

What I gave:

I found a really nice glass pitcher for practically nothing at a place nearby.

Then I found a set of hand towels on sale at my local Family Dollar.

Next I used my Kohl's cash (that I got purchasing a TON of boy's cloths with coupons!) to purchase really nice Food Network brand cooking utensils for free.

So basically I got Karen $94 worth of loot for less than $10!

No, this fact didn't bother me. And I am pretty sure it wouldn't bother her either. Good friends don't care.

So, what have you been able to give on a budget?

Save Money for Rainy Day

Life happens. Lots of life happens. And sometimes life happens all at once. We can't always prepare for life's disasters. But we can be prepared to deal with the financial fallout the best we can.

Life happens. Lots of life happens. And sometimes life happens all at once. We can't always prepare for life's disasters. But we can be prepared to deal with the financial fallout the best we can.

Saving for a rainy day is crucial. It's vital. Do it now.

Last year right after our youngest son, Isaac, was born the AC in my car went out. So there I was, in the middle of June with a newborn baby, an 19 month old and no air conditioner. Oh, and we live in south Alabama where we have 94 degree summer days with 98 percent humidity. It was hot.

And there I stood in the office of my mechanic as he told me that my AC needed fixing. He quoted me a price and he waited for my response.

I watched as he smiled and braced himself for my reaction. He was used to telling people how expensive things like auto repair are. And he was used to getting an animated response.

I nodded my head, opened my wallet and handed him my debit card.

You see, my husband and I had saved for a rainy day. Our rainy day fund wasn't huge. It wasn't enough to live off of, but it was there in case we needed it and we did. It was there for those little emergencies.

Having just an extra $1,000 in the bank gave us room to breath, room to maneuver our way to our goal of being debt free. It gave us the space to relax, pull out our umbrella and wait for the rainbow after the storm.

Cars break down. Kids fall out of trees and break their arms. Tires go flat. Refrigerators die. This is life. Life happens. And some days a lot of life happens all at once.

We didn't compile that extra money in one day. It happened every time I save a few dollars on groceries, every time I sold an item on eBay, every time I scored a new freelance job or a bill was lower than expected. I urge you to save those dollar and cents as fast as you can. But don't get discouraged when you can't save it all over night. One day at a time, one dollar at a time.

Commit to saving just $5 on your groceries this week and putting that money in a jar. Place your old DVDs, books and handbags up for sale or clean out your kid's closet for unused clothes.

Learn how to sell on Amazon to make extra cash. You can do this.

Are you prepared for an emergency?

Four questions to ask yourself before making a big purchase

I wanted to talk to you today about how to control your spending. This is still something I am working on, it's work.

But you see, in order for us to get out of debt, it took some behavior changes. I had to really become intentional in my spending. That was difficult for me. If that's not something you struggle with, great. But for many, it is.

I have already told you how my husband and I dug our way out of debt. And I've talked about ways we save money everyday.

I wanted to talk to you today about how to control your spending. This is still something I am working on, it's work.

But you see, in order for us to get out of debt, it took some behavior changes. I had to really become intentional in my spending. That was difficult for me. If that's not something you struggle with, great. But for many, it is.

So I have four questions I ask myself before I make a purchase.

1. Do I really need this.That's a fair question. Do I really need what I am buying, or do I just think I need it? Is it a want? And what is driving that want? Is it emotional? If it's not a need, or something I have wanted for more than six months and it's at an extraordinary price and I have the extra cash to pay for it... it goes back on the shelf.

2. Do I have something else that will serve the same function?What is that old saying "use it up..."Do I have something I could "make it do?" Do I really need another tshirt? Cardigan? Coffee mug?

3. Where am I going to put it?This is a big one for me. I have declared war on clutter in my house. So before I purchase something I have started to ask where I will put it. And now when I bring something into my house, it usually means something else is LEAVING!

4. Can I get it for a better price else where?Before I buy anything I have gotten in the habit of looking either on Amazon or Craigslist. This has proven to be smart. I recently bought Ry a new booster seat and found one on Amazon for $30. Then I looked on Craislist and found almost the exact same one for a third of the price.

Great finds while shopping at the dollar tree

Dollar Trees are popping up all over the country and giving larger stores a run for their money. I used to think that it was just a place to buy cheap plastic toys and candy. But the Dollar Tree has stepped up its game!

Dollar Trees are popping up all over the country and giving larger stores a run for their money. I used to think that it was just a place to buy cheap plastic toys and candy. But the Dollar Tree has stepped up its game!

I was there just a couple weeks ago to get some stuff for the kiddo's Easter baskets. I bought them tooth brushes, bubbles and socks. (I am trying to not put candy in their baskets, they will get enough of that from the grandparents.)

While I was there I was amaze at what I found.

Nature's Own bread. This is the brand I buy normally, so I was thrilled to find it for a dollar (sometimes they mark it to $.50!). You can stock up on this and stick it in your freezer. It takes no time to thaw!

Healthy frozen entrees. I found great PictSweet frozen vegetables and some frozen fruit. But I was also surprised to find Lyfe Kitchen entrees. If you don't know about Lyfe Kitchen, it's a restaurant chain that boasts healthy, sustainable foods that use local ingredients. They also have a line of frozen entrees.

I found these Breyers no HFCS chocolate pouches. I didn't buy them but I did spot them at the store. And I recently saw a $1 off two coupon in All You Magazine!

Sargento Cheese! Now, these aren't full size packs of cheese, but the price per ounce was cheaper than that of local supermarket, and this is good quality cheese.

I also saw lots of great deal on toothpaste, Bare Minerals make up and cleaning supplies!

Plus Dollar Tree takes manufacterers coupons and up to two printable coupons a day!

Have you found great things at Dollar Tree?

Save Money in Under a Minute with the Ibotta Coupon App

I have seen a lot of coupon blogs talking about the Ibotta app. But I couldn't figure out what the big deal was, until I started saving money on milk and oranges. And by money I mean they give you a cash rebate for these purchases.

I have seen a lot of coupon blogs talking about the Ibotta app. But I couldn't figure out what the big deal was, until I started saving money on milk and oranges. And by money I mean they give you a cash rebate for these purchases.

It's really easy to use (and NO they are not paying me to tell you about this... but they should). You can use it on any iPhone or Android.

Find your store in the list of stores listed in the app. Then find products you already buy. For example, milk!

Some times you have to take a little survey or read a little tip to get more savings, but it takes about two seconds.

Watch the video if you're confused.

Once you've purchased the item you simply scan the item, photograph your reciept, upload it to the app and get your rebate! Bam! Done. And you can use the app on items you already used a coupon on, so sometimes they are free!

Day 2: Spring Clean Your Budget

Today I want to talk to you about priorities. Having a list of where your money is going, of where your spending your hard earned cash, is like a black and white picture of your priorities. Obviously you have to pay your mortgage or your rent. You have to put gas in your car, clothe your kids and feed your family. But where are some places you could cut back.

Good morning! It's day two of "Spring Clean Your Budget!" Yesterday I talked about making a list of where your money is going.

Today I want to talk to you about priorities. Having a list of where your money is going, of where your spending your hard earned cash, is like a black and white picture of your priorities. Obviously you have to pay your mortgage or your rent. You have to put gas in your car, clothe your kids and feed your family. But where are some places you could cut back.

Are you spending a lot on entertainment like going out to eat or on cable when your trying to pay off debt? Those are not bad things, but when you have a bigger goal in mind, those are places you might want to cut back.

However, I know some of you have no where else to cut. Here is a great post about that from Money Saving Mom.

Are there some places you can cut back?

Hack your diaper Genie tutorial

Let's face it, diapers are a way of life when you have babies. And they stink. And you have to dispose of them.

The costs of all these things add up. Here comes the diaper pail! Personally, I thought a garbage can could do the same job. But then someone gave us a pail at our shower and then the baby came and I realized that yes Virginia, diapers do smell.

So I am forever grateful for my diaper genie. But the refills can get expensive. The three packs run $15- $18 on Amazon

.

I am cheap. So I decided to hack my Genie and create my own refills for pennies!

What you'll need:

Your diaper genie

A pack of garbage bags - A pack of 28 for $1 at The Dollar Tree

Take out the insert of Diaper Genie bags. Wrap the garbage bag around the insert.

Pull the garbage bag through the hole.

Feed the bag through the Genie!

Toss the rest of the roll of bags in the bottom of the Genie. I also recommend sprinkling a little baking soda in there.

Voila! Pennies!

Note: This post contains affiliate links. Meaning, if you click the link and make a purchase I do earn a portion of the purchase. I am not asking you to buy anything, I am just being upfront with you guys.

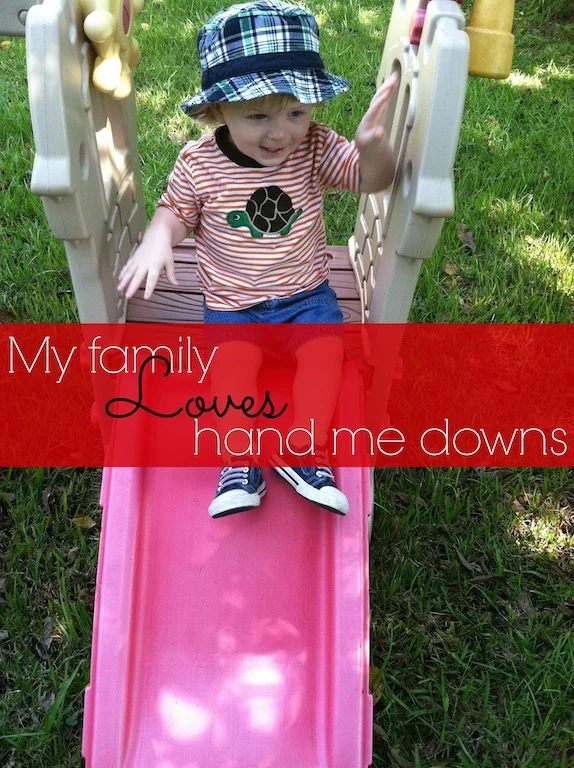

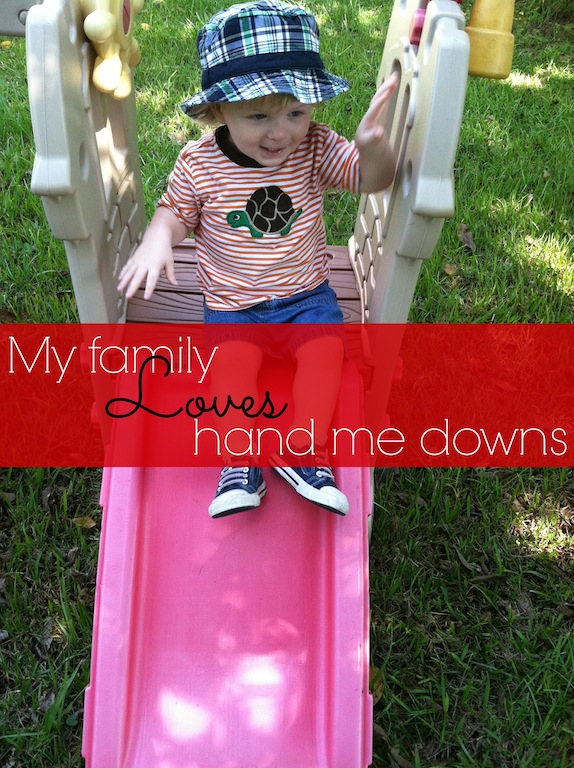

I heart hand me downs…

Our home is filled with hand me downs. The bed my husband and I sleep in, my oldest son's crib, our dining table. The very desk I am sitting at as a type this is a hand me down.

This morning I dressed my children in hand me downs and we went outside to play on hand me down slide.

Our home is filled with hand me downs. The bed my husband and I sleep in, my oldest son's crib, our dining table. The very desk I am sitting at as a type this is a hand me down.

This morning I dressed my children in hand me downs and we went outside to play on hand me down slide.

I wrote about it just last week. Hand me downs are just one of the ways we save money in this house. And I don't feel shame in that.

A very sweet friend of mine has been on a weight loss journey and as she has dropped the pounds she given me some very nice clothes. A few weeks ago we ran into each other at an anointment and there Issie and I were, both dressed in clothes she had given us.

I could afford to go buy a new outfit, in fact I recently did a little clothes shopping. But only to buy a top to match the cute black skirt and equally cute denim jacket she gave me.

I love hand me downs for several reason.

1. They save money.

2. They are envormentally friendly.

3. They are a blessing to the giver and the receiver.

I recently loaded up a box of Issie's old clothes to pass on to my husband's friend. (She is due any day now.) She was thrilled and it was nice to know that the sweet clothes I had loved seeing on my son would again be used by someone I know.

What is the best hand me down you ever recieved?

Five things we do that save HUNDREDS each year

Yesterday I shared with all of you our journey to becoming debt free. Today I wanted share with you five things our family does to save money.

These are pretty basic and you are probably already doing them. If not, maybe this will inspire you.

Yesterday I shared with all of you our journey to becoming debt free. Today I wanted share with you five things our family does to save money, both on daily items and big ticket items.

These are pretty basic and you are probably already doing them. If not, maybe this will inspire you.

1. We are not too good for hand me downs.

We love hand me downs. Both my boys have been outfitted pretty much since birth due to the generosity of my sister and friends. And we have since passed on many of those hand-me-downs.

But we didn't stop there. A few years ago our vacuum cleaner exploded. Literally. The motor exploded. I asked my mom to be on the lookout for a good deal and to pass that info along if she saw one. But my mother just happened to have an extra vacuum she wasn't using! It's not brand new, or the latest and greatest, but it gets the job done and saved me about $200!

2. See if you can get it used.

This sort of goes along with the last one. But, if you can get a good deal on something second hand, go for it.

When I moved Isaac out of his high chair and to a booster seat. I found one I wanted on Amazon for around $30. I was about to hit the "Add to Cart" button when I reconsidered. I hopped onto Craigstlist and found (almost) the exact same booster seat for $10. The best part was, it was only used by the previous owner a couple of times, so it was practically new.

3. Borrow, borrow, borrow

There are things you might need for one season of your life, there is no sense in buying them brand new. I have personally lent out many baby items like our co-sleeper. I know a lot of families who swap baby items back and forth as their children out grow them and as new babies are welcomed into the family.

4. Meal Plan, meal plan, meal plan.

I cannot tell you how invaluable this is. You will save so much time and money by simply meal planning. I am so passionate about this topic I even put together an ebook about it.

I estimated that it saves our family around $1,600 a year in meal planning and it saves me hours of time.

5. DON'T SPEND MONEY.

I know, you just had your mind blown, didn't you?

But before you spend money ask yourself these questions:

Do I really need this?

Can I live without it?

Do I have something else that will do the same job?

Can I borrow this?

Do I really want it?

Like I said, these are basic and we're not reinventing the wheel here at the Senn house, but these simple tools have really helped us carve our way out of debt and get on the path to financial freedom.

What are some ways you save money?

Waste not want not: the empty peanut butter jar

We threw away half our food last year. We wasted $165 billion. (source) By we I mean the United States.

I am guilty of throwing things out, I shove then in the freezer with good intentions and then months later I toss them in the trash can.

I talk a lot about meal planning here because it saves time and money, but it also reduces waste.

I had been thinking a lot about this last week. I reached my hand into the cupboard to find an empty peanut butter jar. I got frustrated and went throw it out when I realized it wasn't empty. There was still a whole serving in there, I just had to get out my rubber spatula and scrap it out of the jar. Peanut butter is on average $.13 a serving. That $.13 wasn't going to make or break me, but it was principle.

Sometimes saving something isn't about the money we save. It's about being grateful, not being wasteful, being good stewards of our resources and remembering that there is a person in the world for whom two tablespoons of peanut butter is a luxury.